How to Navigate Uncertainty in 2025

(and Beyond)

Uncertainty. It’s a word on everyone’s mind. And for good reason. From January’s wildfires and fluctuating mortgage rates to economic shifts and limited inventory, there’s a lot in flux. We’re in a period of transition—shaped by changing policies, market volatility, and global events. Where will it all lead? No one knows exactly, but one thing remains clear:

Real Estate Endures the Ups and Downs

of Economic Cycles & Market Dynamics

Real estate continues to be one of the most reliable long-term investments in the Greater Los Angeles area. Whether you’re buying, selling, investing, or just watching the market—this moment presents both challenges and opportunities.

Let’s dig in…

_____

Home Prices & Mortgage Rates

These are two things that it seems every individual and family in Los Angeles is attuned to. The housing market is shifting, and with spring around the corner, buyers and sellers are looking for clarity.

Home Prices: A Return to Normalcy?

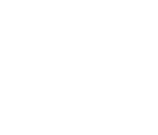

After the volatility of the past few years, home prices appear to be stabilizing. CoreLogic’s Selma Hepp puts it this way: “Home prices have mostly been moving sideways, a trend that may continue into the early months of 2025.” And according to the latest FHFA House Price Index, U.S. home prices rose 4.5% year-over-year and 1.4% quarter-over-quarter in Q4 2024. While this suggests continued appreciation, the pace has slowed compared to previous years—a sign of a more balanced market.

Four-Quarter House Price Change by State

US Four-Quarter Appreciation = 4.5%

(2023 Q4 – 2024 Q4)

Source: FHFA HPI

Nationally, price trends are normalizing, with most markets seeing steady, moderate appreciation. However, real estate remains local, and understanding your market is critical. The Los Angeles housing market has shown resilience, with the median home price reaching approximately $883,312, reflecting a 3.9% increase from last year.

The Wildfire Effect

The January 2025 wildfires in Pacific Palisades and Altadena destroyed thousands of homes, tightening housing supply and increasing demand for rentals. As displaced residents seek temporary housing, rental markets are surging.

Despite the setback, the market remains active. Sales rose 4.6% from January to February, and 41.3% of homes sold above asking—many with multiple offers.

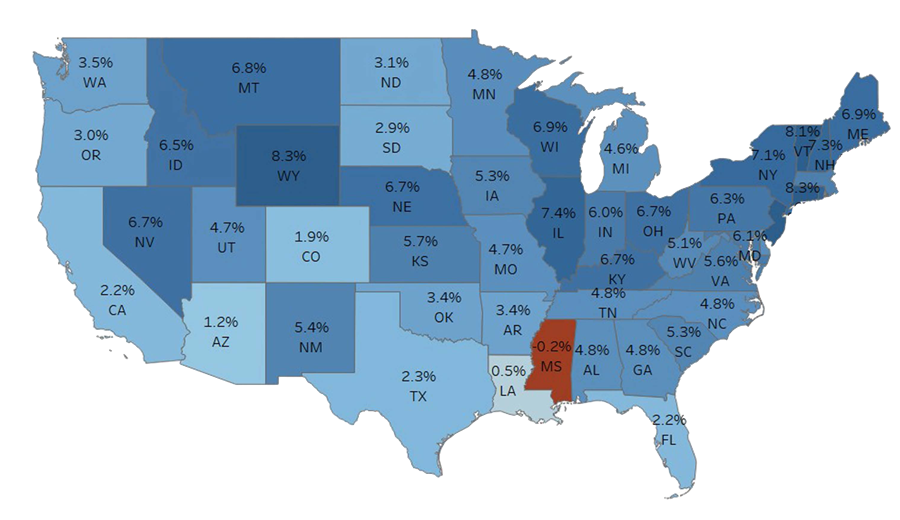

Mortgage Rates: A Positive Shift

Any positive news is welcomed, and rates are no exception. Rates have been trending downward since peaking above 7%. Now hovering around 6.7%, they’re slightly better than projected for this time of year. While the drop isn’t dramatic, it’s meaningful—reducing monthly payments and boosting purchasing power by tens of thousands of dollars.

Freddie Mac’s Sam Khater sums it up well:

“The drop in mortgage rates combined with modestly improving inventory is an encouraging sign for consumers in the market to buy a home.”

Mortgage Rates Have Declined This Year

Average 30-Year Fixed Mortgage Rate in 2025

Source: Freddie Mac

________________________________________________

Exclusive Interview: Market Trends, Wildfires & the Future of LA Real Estate

I recently had the pleasure of sitting down with Michael Winestone on From the Ground Up to discuss the evolving Los Angeles real estate market. We covered everything from market volatility, the impact of the recent wildfires, changes in home construction, and what’s next for different LA neighborhoods.

Michael always brings great insight, and I’m grateful for the opportunity to chat with him about the trends shaping our industry.