Rising Rates Have Everyone Talking

(and some reacting)

A day doesn’t go by that someone doesn’t ask me about mortgage rates. “What are the rates doing?” “Are rates going to keep rising?” “How are interest rates impacting the market?” “Will interest rates level off soon?” And so on. These are all good questions—and critical to understanding today’s housing market now, and in the near future. But, the bigger, more impactful question has less to do with interest rates and more to do with a lack of supply. The fact is, there is a drastic shortage of available inventory in today’s market. So what does that mean?

___________

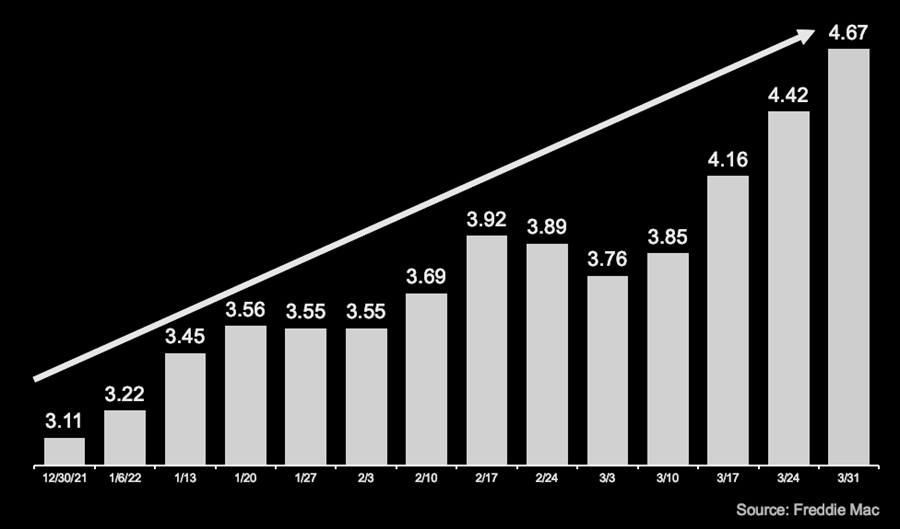

Mortgage Rates Rising This Year

Freddie Mac Average 30-Year Fixed Rate: January – March 2022

“Based on the current estimate for the peak Fed Funds rate (3.25% to 4.0%), the 30-year fixed mortgage will likely peak at between 5.0% and 5.7%. There is some variability in the relationship, so we might see rates as high as the low 6.0% range…”

Bill McBride, Calculated Risk

KEY OBSERVATION

Regardless of the market and rates, people buy and sell houses based on life events: a marriage, a new baby, a new job, and so forth. They may adjust their purchase price on what they can afford—or their sell price on what they can get in a given market—but they will ultimately be driven by lifestyle factors, not ever-shifting rates.

IN BLACK & WHITE

With all indicators pointing to a hot market, what does that mean to sellers and buyers? For sellers, now’s the time. The fact that many homeowners will enjoy strong equity gains, means that they will have more opportunities as they begin their search for a new home. In many cases, those extra gains could be enough to cover much (if not all) of the down payment on their next house.

As for buyers, don’t despair, but also don’t rush in. Be cautious. Don’t panic. Don’t let fear drive your purchasing decision. Make sure you enlist the help of an experienced broker who can help you navigate the nuances and avoid potential pitfalls. There are still good buys out there—especially when you consider your next home should be a sound investment that grows in value over several years.

Be well,

Charles